Creditcardshavebecomeawayoflife.Hereissomebasicinformationabouthowtheywork.Intodaysworld,younolongerneedtocarrymoneywithyouwhenyougooutshopping.Youcansimplypayforyourpurchasesusingasmallplasticcardknownasacreditcard.Acreditcardprimarilyallowsyoutopurchaseitemsandpayforthemlateron.Acreditcardcanbebeneficial,asyoudonothavetoworryaboutcarryinglargeamountsofmoneyinapublicplace.Readonforaninsightintohowacreditcardfunctions.InthisarticleApplyingforaCardVerifyingaCardataStoreCarryingoutaTransactionPayingtheCreditCardCompanyApplyingforaCardAnyindividualovertheageof18canlegallyhaveacreditcardinhisname.Creditcardcompaniesusuallycalluppotentialcustomerstoadvertisetheirvariouscreditcards.Formostcompanies,havingasourceofincomeisnotacompulsoryrequirementtoobtainacreditcard.Nowadays,manybanksalsooffercreditcards,mostlytocustomerswhohaveanaccountwiththebank.VerifyingaCardataStoreAcreditcardcanonlybeusedatastorewhichacceptsthecreditcardofthatparticularcompany.Onceastoremerchanthasdeterminedthatyourcardisacceptedatthestore,hewillfirstcarryoutapreliminarycheckonthecard.Thisinvolvesdeterminingifthecardisauthentic,byswipingthecardonamachineconnectedtohiscomputerandcheckingifthenumbermatchesthenameonthecard.Thisiscarriedoutwiththehelpofspecialsoftwareinstalledonthecomputerbythebank.Themerchantalsochecksthecreditlimitofthecard.Manycardownersimposealimitofaparticularamounttobespentonaparticulartransactionorforthetotalamountspentinoneday.Accordingly,themerchantcandetermineifthecardownerisallowedtomakethepurchase.Itcanalsotellamerchantwhetherthecardownerhasdefaultedonpaymentsforearlierpurchases.Alltheseverificationproceduresdependontheinformationstoredinasmallelectronicchipinthecard.Thisinformationcanalsobeobtainedifthemerchanttypesinthecardspersonalidentificationnumber(PIN).Thisisathree-digitnumberonthebackofacreditcard.Thisverificationmethodisusedprimarilyforcarryingoutonlinetransactions,wherethemerchantcannotphysicallyswipeyourcard.CarryingoutaTransactionOnceacardhasbeenverified,thetransactioncanproceed.Acreditcardcanmakeapaymentonlybyusingacreditcardterminal.Thisterminalisamachinewherethecreditcardcanbeswiped.Onswipingthecard,apaperreceiptisgenerated.Thecardownerthensignsonthisreceiptintwoplaces.Thesignatureconfirmsthatthecardownerhasagreedtopaythecardissuingcompany.Essentially,inacreditcardtransaction,thecardcompanypaystheamounttothemerchantandtheownerpaysthecardcompanyafteracertainnumberofdays.PayingtheCreditCardCompanyEverymonth,thecardownerreceivesastatementfromthecreditcardcompany,detailingthevariouspurchasesmadeandthetotalamountdue.Thestatementmayalsohaveaddedfeesifthecardownerhasnotsuccessfullyclearedhispreviousbills.Themainadvantageofacreditcardisthatacard-ownerdoesnothavetocompulsorilypaytheentireamountatonetime.Cardcompaniesmentionaminimumamountthattheownermustpayeverymonth.Thebalanceamountcanthenbepaidlateron.Thedownsidetothisisthatthecard-ownerischargedinterestonthebalanceamountdue.Thesearecalledoutstandingfees.Theinterestrateonoutstandingbalancesisextremelyhigh,comparedtotheinterestratesfortraditionalbankloans.Thoughcreditcardsareconvenient,theymustalsobeusedwithcaution.Itisveryeasyforacard-ownertofindhimselfincreditcarddebt,withoutevenrealisingit.

Credit cards have become a way of life. Here is some basic information about how they work. In today's world, you no longer need to carry money with you when you go out shopping. You can simply pay for your

purchases using a small plastic card known as a credit card. A credit card primarily allows you to purchase items and pay for them later on. A credit card can be beneficial, as you do not have to worry about carrying large amounts of money in a public place. Read on for an insight into how a credit card functions.

Applying for a Card

Any individual over the age of 18 can legally have a credit card in his name. Credit card companies usually call up potential customers to advertise their various credit cards. For most companies, having a source of income is not a compulsory requirement to obtain a credit card. Nowadays, many banks also offer credit cards, mostly to customers who have an account with the bank.

Verifying a Card at a Store

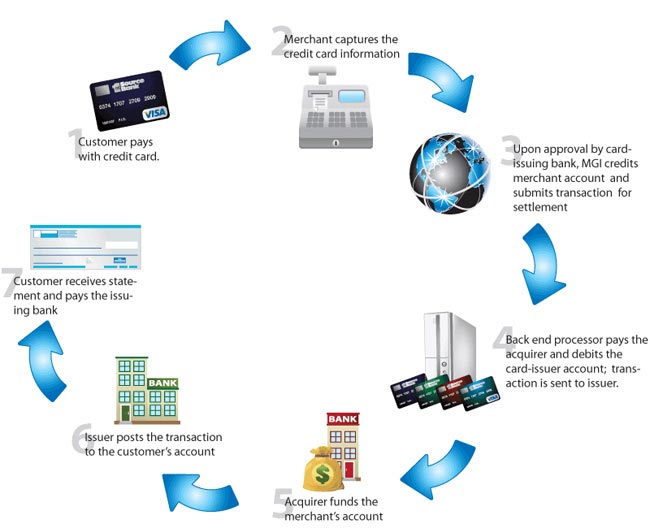

A credit card can only be used at a store which accepts the credit card of that particular company. Once a store merchant has determined that your card is accepted at the store, he will first carry out a preliminary check on the card. This involves determining if the card is authentic, by swiping the card on a machine connected to his computer and checking if the number matches the name on the card. This is carried out with the help of special software installed on the computer by the bank.

The merchant also checks the credit limit of the card. Many card owners impose a limit of a particular amount to be spent on a particular transaction or for the total amount spent in one day. Accordingly, the merchant can determine if the card owner is allowed to make the purchase. It can also tell a merchant whether the card owner has defaulted on payments for earlier purchases.

All these verification procedures depend on the information stored in a small electronic chip in the card. This information can also be obtained if the merchant types in the card's personal identification number (PIN). This is a three-digit number on the back of a credit card. This verification method is used primarily for carrying out

online transactions, where the merchant cannot physically swipe your card.

Carrying out a Transaction

Once a card has been verified, the transaction can proceed. A credit card can make a 'payment' only by using a credit card terminal. This terminal is a machine where the credit card can be swiped. On swiping the card, a paper receipt is generated. The card owner then signs on this receipt in two places. The signature confirms that the card owner has agreed to pay the card issuing company. Essentially, in a credit card transaction, the card company pays the amount to the merchant and the owner pays the card company after a certain number of days.

Paying the Credit Card Company

Every month, the card owner receives a statement from the credit card company, detailing the various purchases made and the total amount due. The statement may also have added fees if the card owner has not successfully cleared his previous bills. The main advantage of a credit card is that a card-owner does not have to compulsorily pay the entire amount at one time. Card companies mention a minimum amount that the owner must pay every month. The balance amount can then be paid later on.

The downside to this is that the card-owner is charged interest on the balance amount due. These are called outstanding fees. The interest rate on outstanding balances is extremely high, compared to the interest rates for traditional bank loans.

Though credit cards are convenient, they must also be used with caution. It is very easy for a card-owner to find himself in credit card debt, without even realising it.